Making Money with Insurance in the USA , A Comprehensive Guide

Insurance is often viewed as a necessary expense, but for those with the right knowledge and strategies, it can also be a lucrative avenue for generating income. In the United States, the insurance industry is a multi-trillion-dollar sector that offers numerous opportunities for financial growth. Whether you are an entrepreneur, an investor, or a professional looking to diversify your income streams, understanding how to make money with insurance can be a game-changer. This comprehensive guide will explore various strategies to profit from the insurance industry, including starting an insurance agency, investing in insurance stocks, becoming an insurance broker, and more.

Table of Contents

- Introduction to the Insurance Industry

- Starting Your Own Insurance Agency

- Becoming an Insurance Broker

- Investing in Insurance Stocks and Bonds

- Niche Insurance Markets

- Online and Digital Insurance Platforms

- Insurance Adjusting and Consulting

- Selling Insurance Leads

- Creating Insurance-Related Content

- Partnering with InsurTech Companies

- Conclusion

1. Introduction to the Insurance Industry

The insurance industry in the United States is one of the largest and most complex sectors of the economy. It encompasses a wide range of products, including health insurance, life insurance, auto insurance, home insurance, and commercial insurance. The industry is regulated by both federal and state laws, ensuring that companies operate fairly and consumers are protected.

Key Players in the Insurance Industry

- Insurance Companies: These are the primary providers of insurance products. They underwrite policies and assume the risk for the insured.

- Insurance Agents and Brokers: These professionals sell insurance policies on behalf of insurance companies. Agents typically represent one company, while brokers can offer policies from multiple insurers.

- Reinsurance Companies: These companies provide insurance for insurance companies, helping them manage risk and maintain financial stability.

- Regulatory Bodies: Organizations like the National Association of Insurance Commissioners (NAIC) and state insurance departments oversee the industry to ensure compliance with laws and regulations.

Understanding the dynamics of the insurance industry is crucial for anyone looking to make money in this field. The following sections will delve into specific strategies for generating income through insurance.

2. Starting Your Own Insurance Agency

Starting an insurance agency can be a highly profitable venture if done correctly. As an agency owner, you will sell insurance policies to individuals and businesses, earning commissions on each sale. Here’s a step-by-step guide to starting your own insurance agency:

Step 1: Obtain the Necessary Licenses

Before you can start selling insurance, you need to obtain the necessary licenses. Each state has its own licensing requirements, but generally, you will need to:

- Complete pre-licensing education courses

- Pass a state licensing exam

- Submit a license application and pay the required fees

- Undergo a background check

Step 2: Choose Your Niche

The insurance market is vast, so it’s essential to choose a niche that aligns with your interests and expertise. Common niches include:

- Auto insurance

- Homeowners insurance

- Life insurance

- Health insurance

- Commercial insurance

Step 3: Develop a Business Plan

A well-thought-out business plan is crucial for the success of your insurance agency. Your plan should include:

- Market analysis

- Target audience

- Marketing and sales strategies

- Financial projections

- Operational plan

Step 4: Secure Funding

Starting an insurance agency requires an initial investment for office space, technology, marketing, and other expenses. You can secure funding through:

- Personal savings

- Bank loans

- Investors

- Small Business Administration (SBA) loans

Step 5: Build Relationships with Insurance Carriers

To offer a variety of insurance products, you need to establish relationships with multiple insurance carriers. This will allow you to provide your clients with competitive rates and comprehensive coverage options.

Step 6: Hire and Train Staff

As your agency grows, you’ll need to hire and train staff to help you manage operations and sell policies. Invest in ongoing training to ensure your team stays up-to-date with industry trends and regulations.

Step 7: Market Your Agency

Effective marketing is essential for attracting clients to your agency. Utilize a mix of online and offline marketing strategies, such as:

- Social media marketing

- Search engine optimization (SEO)

- Content marketing

- Networking events

- Direct mail campaigns

Starting an insurance agency requires dedication, hard work, and a strategic approach, but it can be a highly rewarding business with the potential for significant financial returns.

3. Becoming an Insurance Broker

If starting an insurance agency seems too daunting, becoming an insurance broker is another viable option. Insurance brokers act as intermediaries between clients and insurance companies, helping clients find the best insurance policies to meet their needs.

Benefits of Being an Insurance Broker

- Flexibility: Brokers can work independently or for brokerage firms, offering flexibility in terms of work environment and schedule.

- Variety: Brokers can offer policies from multiple insurers, providing clients with a wider range of options.

- Earning Potential: Brokers earn commissions on the policies they sell, and successful brokers can earn a substantial income.

Steps to Becoming an Insurance Broker

- Education and Licensing: Similar to starting an agency, you’ll need to complete pre-licensing education, pass a state licensing exam, and obtain the necessary licenses.

- Gain Experience: Many brokers start their careers working for insurance agencies or brokerage firms to gain experience and build a client base.

- Build a Network: Networking is crucial for brokers. Attend industry events, join professional organizations, and build relationships with insurance carriers to expand your network.

- Develop Expertise: Specializing in a particular niche can set you apart from other brokers and make you a go-to expert in that area.

- Market Yourself: Create a professional website, leverage social media, and use content marketing to establish your online presence and attract clients.

Becoming an insurance broker requires dedication and a commitment to ongoing education and networking, but it can be a highly rewarding career with significant earning potential.

4. Investing in Insurance Stocks and Bonds

Investing in insurance stocks and bonds is another way to make money with insurance. Insurance companies are often stable and profitable, making them attractive investments for those looking to diversify their portfolios.

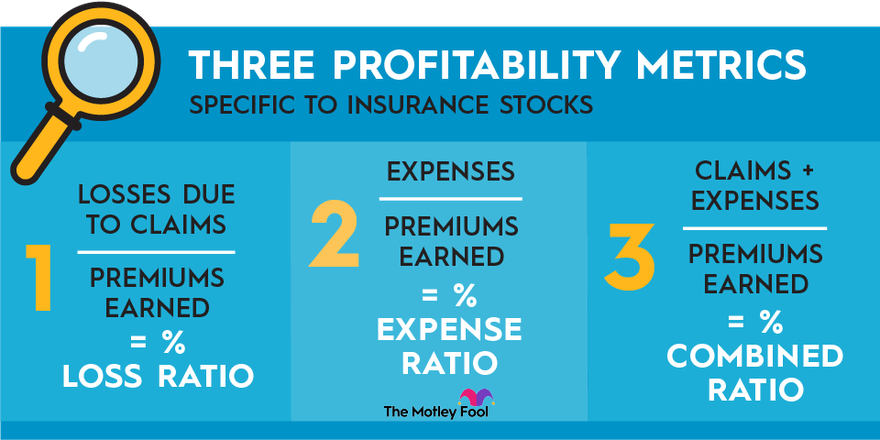

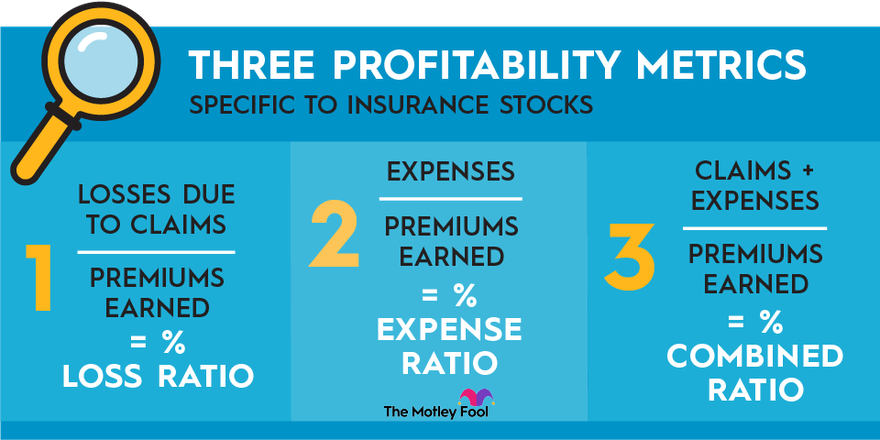

Investing in Insurance Stocks

Insurance stocks represent ownership in insurance companies. When you purchase shares of an insurance company, you become a partial owner and can benefit from the company’s profits through dividends and stock price appreciation.

Benefits of Investing in Insurance Stocks

- Stable Dividends: Many insurance companies pay regular dividends to shareholders, providing a steady income stream.

- Growth Potential: As the insurance industry continues to grow, well-managed insurance companies can see significant stock price appreciation.

- Diversification: Insurance stocks can add diversification to your investment portfolio, reducing overall risk.

How to Invest in Insurance Stocks

- Research: Conduct thorough research on insurance companies, analyzing their financials, growth potential, and market position.

- Choose a Broker: Open a brokerage account with a reputable online broker that offers access to insurance stocks.

- Buy Shares: Purchase shares of the insurance companies you’ve researched and monitor your investments regularly.

- Diversify: Consider investing in a mix of life, health, property, and casualty insurance companies to diversify your holdings.

Investing in Insurance Bonds

Insurance bonds are debt securities issued by insurance companies to raise capital. When you invest in insurance bonds, you are essentially lending money to the insurance company in exchange for regular interest payments and the return of the principal amount at maturity.

Benefits of Investing in Insurance Bonds

- Regular Income: Bonds provide regular interest payments, offering a predictable income stream.

- Lower Risk: Bonds are generally considered lower risk compared to stocks, making them suitable for conservative investors.

- Portfolio Diversification: Adding bonds to your investment portfolio can help balance risk and return.

How to Invest in Insurance Bonds

- Research: Review the credit ratings and financial health of insurance companies issuing bonds.

- Choose a Broker: Open an account with a brokerage firm that offers access to insurance bonds.

- Buy Bonds: Purchase bonds from the insurance companies you’ve researched and hold them until maturity or sell them on the secondary market if needed.

Investing in insurance stocks and bonds can provide a stable income stream and growth potential, making it a viable strategy for making money with insurance.

5. Niche Insurance Markets

Exploring niche insurance markets can be a profitable strategy for making money with insurance. Niche markets cater to specific groups of clients with unique insurance needs, allowing you to offer specialized products and services.

Examples of Niche Insurance Markets

- Pet Insurance: With the increasing number of pet owners, pet insurance has become a growing market. Offering policies that cover veterinary expenses can attract pet owners looking to protect their furry companions.

- Travel Insurance: Travel insurance provides coverage for trip cancellations, medical emergencies, and lost luggage. Targeting frequent travelers and travel agencies can be a lucrative niche.

- Cyber Insurance: As cyber threats continue to rise, businesses are seeking coverage for data breaches and cyberattacks. Offering cyber insurance can cater to the growing demand for digital security.

- Wedding Insurance: Wedding insurance covers unexpected events that can disrupt a wedding, such as vendor cancellations or severe weather. Targeting engaged couples and wedding planners can be a profitable niche.

- Sports and Entertainment Insurance: This niche provides coverage for athletes, entertainers, and events. Policies can include liability coverage, injury protection, and event cancellation.

How to Succeed in Niche Insurance Markets

- Identify a Niche: Research and identify a niche market with growing demand and limited competition.

- Develop Expertise: Gain in-depth knowledge and expertise in the niche market to become a trusted advisor.

- Tailor Products: Customize insurance products to meet the unique needs of

0 comments:

Post a Comment